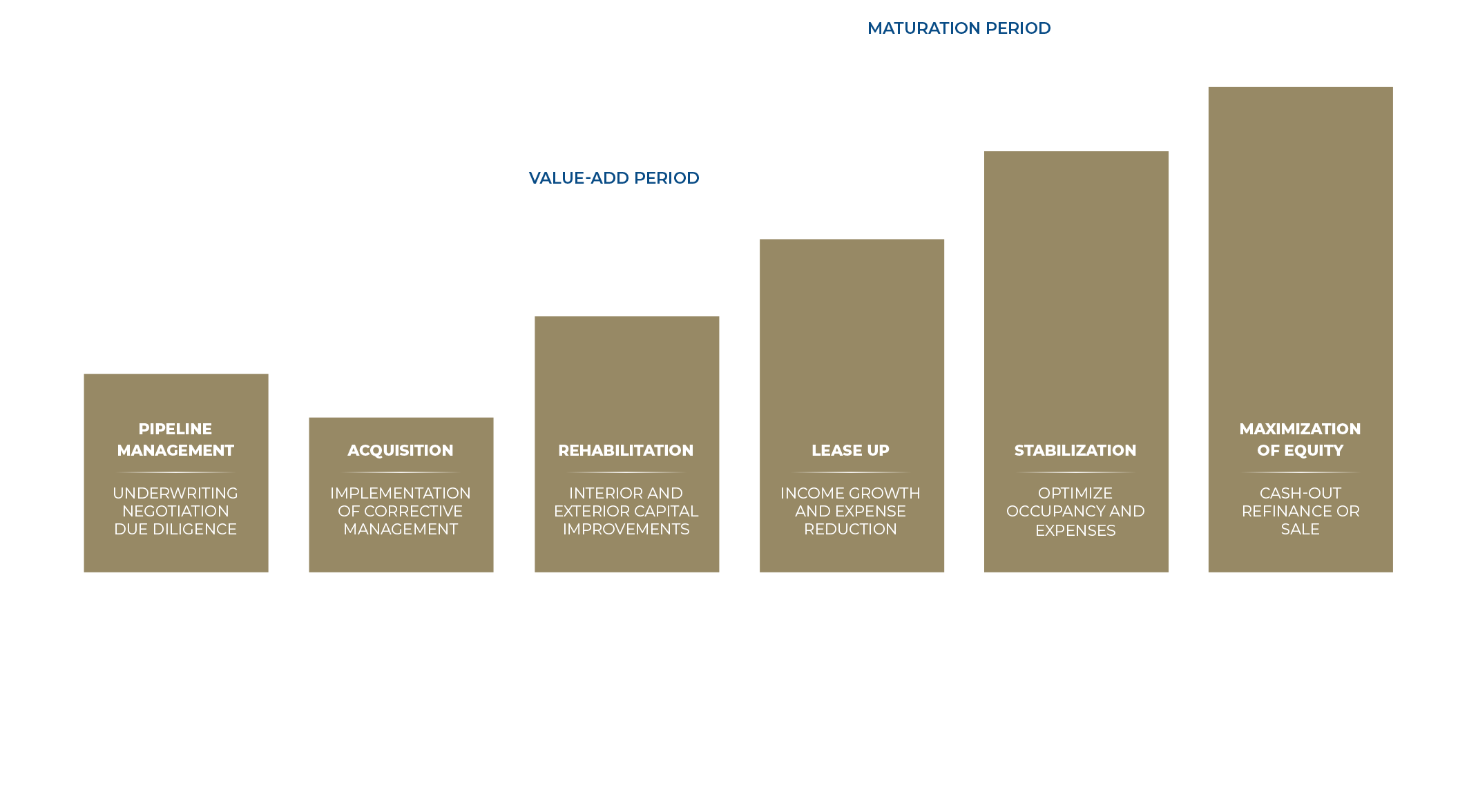

VALUE-ADD STRATEGY

RENOVATE

Our Value-Add Strategy

We seek to acquire deals that are underperforming and able to be bought at less than replacement cost. These opportunities originate through the relationships our subsidiaries hold with numerous vendors, owners, and management companies, which in turn positions us to be front and center when an opportunity arises. We typically add value through 3 channels;

HEAVY VALUE-ADD COMPONENT

IMPROVEMENTS THROUGH PROPERTY MANAGEMENT

MARKET REPOSITIONING / BRANDING

STREAMLINE

Our Value-Add Strategy

Acquire an existing asset that is performing well but could benefit from operational enhancements.

RECALIBRATE

Our Value-Add Strategy

Acquire an existing asset and seek to deploy less than $15k / unit in strategic capex improvements.

Newer properties that could benefit from a first-generation upgrade.

Target assets located in markets with diverse employment bases, strong forecasted market fundamentals and liquidity.

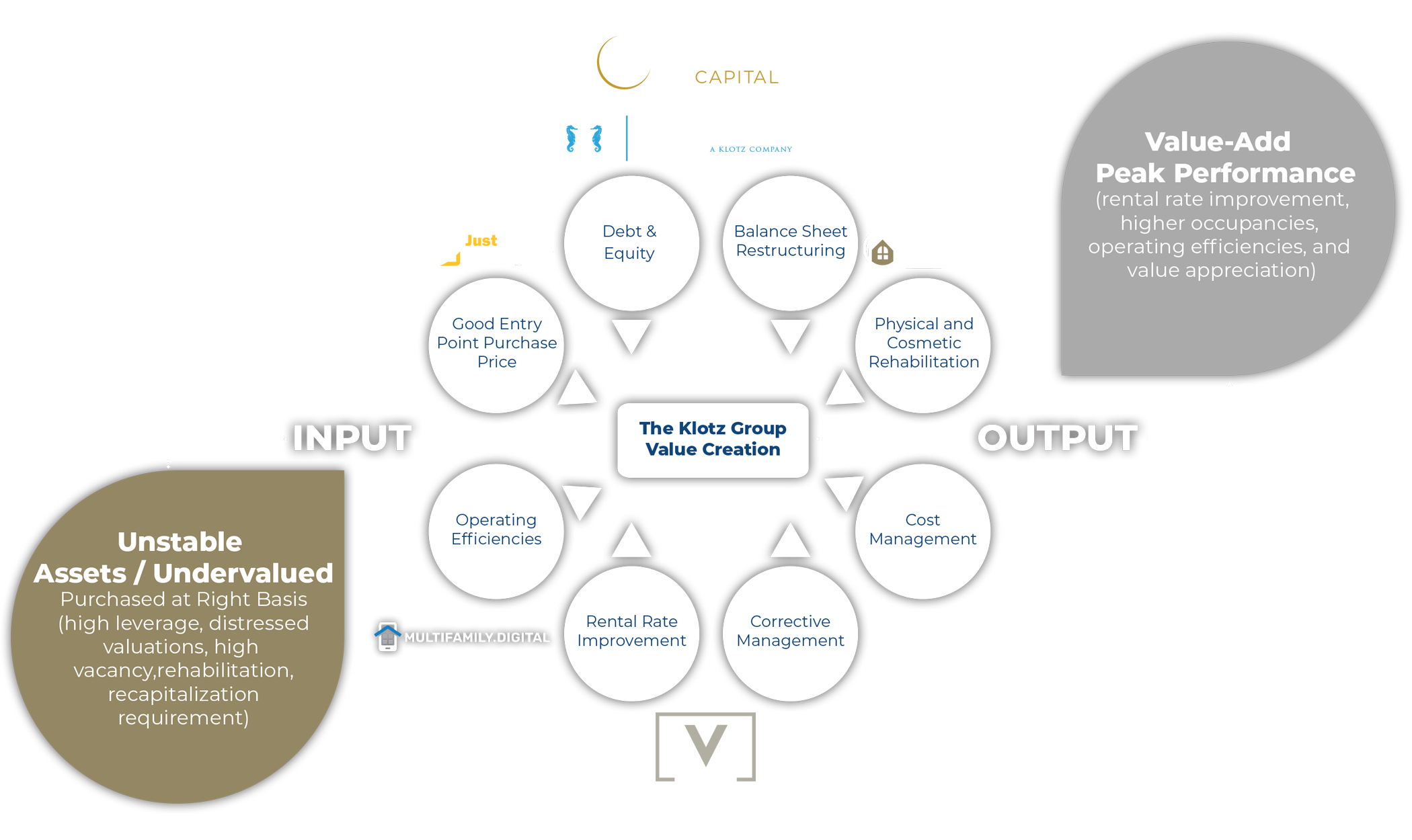

THE KLOTZ GROUP

FULLY INTEGRATED OPERATING PLATFORM CREATES VALUE BY CONTROLLING RESOURCES AND GENERATING “OFF MARKET” ACQUISITION TARGETS

AMVESTAR CAPITAL

VERTICALLY INTEGRATED MULTIFAMILY