AMVESTAR CAPITAL

AmveStar Capital is a leading vertically integrated private equity real estate firm based in Northeast Florida that develops, acquires, and repositions multifamily properties in the SOUTHEASTERN U.S. AND TEXAS. Since 1995, along with its principals and affiliates, they have completed over 40 ground-up development projects, owned / operated over 50,000 units, and sponsored or co-sponsored over $2 billion of invested assets.

AmveStar gives institutional and accredited investors the opportunity to diversify their assets and aims to earn significant returns associated with high-quality real estate investments via individual properties, diversified real estate funds, and programmatic joint ventures.

Having navigated multiple cycles over the past three decades, AmveStar is once again seeing opportunities to acquire off-market special situation assets that can be repositioned to generate strong returns.

AMVESTAR CAPITAL SPECIALIZES IN THE MULTIFAMILY INDUSTRY WITH TWO DISTINCT BUSINESS STRATEGIES:

VALUE-ADD: Repositioning Class B and C multifamily properties, in A to B markets targeting high yield potential, followed by sale.

OPPORTUNISTIC (GROUND-UP DEVELOPMENT): Building garden-style luxury multifamily properties.

AMVESTAR CAPITAL

OUR COMPETITIVE EDGE

EXTENSIVE

EXPERIENCE

AmveStar’s leadership has over 100 years of combined multifamily experience and has operated as an organization for 30+ years, navigating multiple market cycles.

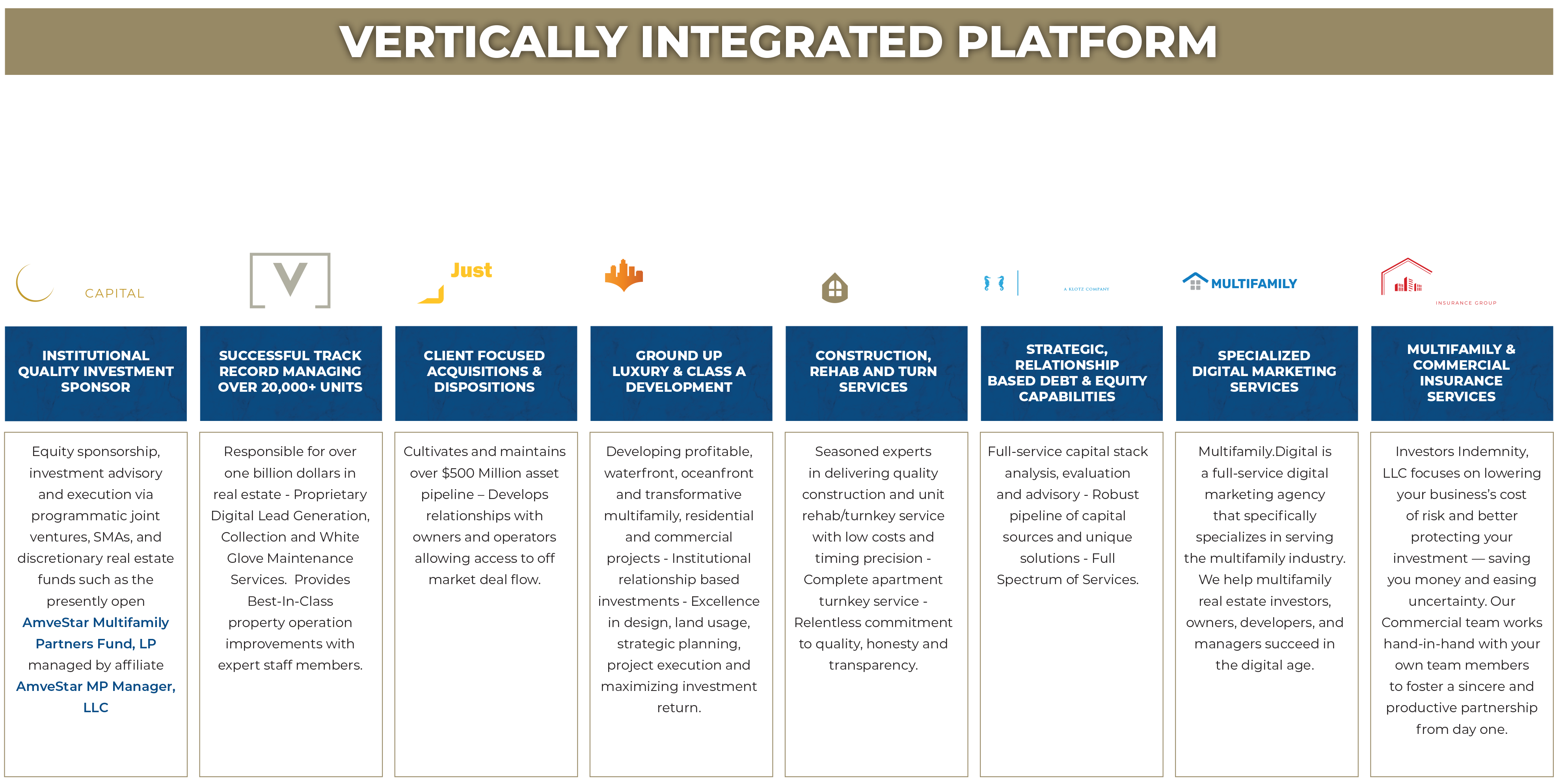

AmveStar’s “end-to-end” collection of affiliate companies constitutes a completely integrated platform.

VERTICALLY INTEGRATED PLATFORM

For investors, the benefit of the platform is that AmveStar is:

Singly capable of, and solely responsible for the execution of investment business plans.

Able to generate a robust pipeline of off-market acquisition opportunities.

FLEXIBILITY

& SPEED

Investments for select investors can be customized to meet their risk/reward needs and holding periods.

Investment vehicles are structured to enable AmveStar to move quickly when buying opportunities surface, enhancing returns.